santa clara county property tax rate

The Santa Clara County Office of the Tax Collector collects approximately 4 billion in county city school district and special district property taxes each year. What is a vendor tax id number.

How Has Prop 13 Affected Tax Distribution In Santa Clara County San Jose Spotlight

The 2022 KQED Voter Guide covers the key races in local Santa Clara County elections.

. The median property tax in St. A tax lien is a legal claim that a local or municipal government places on an individuals property when the owner has failed to pay a property tax debt. Age gender raceethnicity source of.

Missouri has one of the lowest median property tax rates in the United States with only fifteen states collecting a lower median property tax than Missouri. States and Washington DC. You will have to file Form PD5 with your tax collector every year on or before March 1 to maintain the deduction.

New Yorks median income is 74777 per year so the median yearly property. Make sure you review your tax card and look at comparable homes. Situated on the eastern shore of the San Francisco Bay Alameda County contains the cities of Oakland Berkeley and Fremont among others.

He pocketed a 40000 profit from the sale. Santa Clara County collects on average 067 of a propertys assessed fair market value as property tax. Clair County collects on average 187 of a propertys assessed fair market value as property tax.

Missouris median income is 56517 per year so the median yearly property tax paid by Missouri. New York has one of the highest average property tax rates in the country with only three states levying higher property taxes. Santa Clara County has one of the highest median property taxes in the United States and is ranked 38th of the 3143 counties in order of median.

Demographics of Cases and Deaths Provides information on characteristics and demographics of COVID-19 cases and deaths including. Property taxes are levied on land improvements and business personal property. Clair County Illinois is 2291 per year for a home worth the median value of 122400.

The median property tax in Connecticut is 163 of a propertys assesed fair market value as property tax per year. Connecticuts median income is 85993 per year so the median yearly. Proposition 13 the property tax limitation initiative was approved by California voters in 1978.

How to Appeal if Your Application Is Denied. The median annual property tax payment in Santa Clara County is 6650. The median property tax in West Virginia is 46400 per year049 of a propertys assesed fair market value as property tax per year.

The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000. The median property tax in Texas is 181 of a propertys assesed fair market value as property tax per year. How to get your heart rate up fast.

Delaware County collects the highest property tax in Ohio levying an average of 148 of median home value yearly in property taxes while Monroe County has the. Finally the Tax Collector prepares property tax bills based on the County Controllers calculations distributes the bills and then collects the. The stadium is located approximately 40 miles 64 km south of San Francisco.

It limits the property tax rate to 1 of assessed value ad valorem property tax plus the rate necessary to fund local voterapproved debt. The largest Hispanic or Latino groups were those of Mexican 179 Salvadoran 13 Guatemalan 06 Puerto Rican 06 and Nicaraguans 05 ancestry. When Santa Clara City Council candidate Larry McColloch bought a home in Santa Rosa nearly two decades ago he promised the lender he would live in it for at least a year potentially earning him a low interest rate.

After applying tax rates the County Controller calculates the total tax amount. An effective property tax rate differs from the 1 percent basic rate in that it is the amount of property taxes paid divided by the current market value of the property. The median property tax in Missouri is 091 of a propertys assesed fair market value as property tax per year.

Ohio is ranked 20th of the 50 states for property taxes as a percentage of median income. He never lived in it. Tax amount varies by county.

After a municipality issues a tax lien. The Latino population is spread throughout the Bay Area but among the nine counties the greatest number live in Santa Clara County while Contra Costa County sees the highest growth rate. Sheriff San Jose Mayor District 1.

8 days ago Todays top 2000 Supplier. As of 61022 new case counts include cases that are presumed reinfections defined as a positive test more than 90 days after the first positive test for a previous infection. In addition the assessed value of commercial property in Santa Clara County has declined as a share of the county total from 29 percent to 24 percent since 199900.

This dashboard shows the 7-day daily average COVID-19 case rate by day for Santa Clara County overall for unvaccinated residents and for fully vaccinated residents. This data base is the basis for all property tax bills within the County including all municipalities school districts and special districts and is vital intellectual property. File Form PTD and all documentary proofs with your local assessor or tax collector.

Due to the fact that Santa Clara County is home to several major hospitals there are in general more deaths that occur in the county than deaths of county residents. The median property tax in New York is 123 of a propertys assesed fair market value as property tax per year. Orange County colloquially known as OC each letter pronounced individually is a county located in the Los Angeles metropolitan area in Southern CaliforniaAs of the 2020 census the population was 3186989 making it the third-most populous county in California the sixth most populous in the US and more populous than 27 US.

Texas has one of the highest average property tax rates in the country with only thirteen states levying higher property taxes. 2017 TENTATIVE Assessment Roll-Changes Before May 1st Filing-Santa Clarapdf. Learn more about SCC DTAC Property Tax Payment App.

But just three months later McColloch sold the home. Business and personal property taxpayers in Santa Clara County now have access to SCC DTAC a new mobile app launched by the County of Santa Clara Department of Tax and Collections to provide more than 500000 property owners with convenient access to pay their secured property tax payments. The property tax rate in the county is 078.

Connecticut has one of the highest average property tax rates in the country with only one states levying higher property taxes. It is named after Levi Strauss Co which purchased naming. Clair County has one of the highest median property taxes in the United States and is ranked 328th of the 3143 counties in order of median property taxes.

Texass median income is 62353 per year so the median yearly property tax. Tax amount varies by county. The property taxes you pay on a home are called secured taxes.

Tax amount varies by county. If your application is denied you can file an appeal with the County Board of Taxation. 2000 Supplier Quality Engineer contract jobs in United Posted.

Levis Stadium is an American football stadium located in Santa Clara California just outside San Jose in the San Francisco Bay AreaIt has served as the home venue for the National Football League NFLs San Francisco 49ers since 2014. Property taxes are calculated by multiplying your municipalitys effective tax rate by the most recent assessment of your property. The exact property tax levied depends on the county in Ohio the property is located in.

West Virginias median income is 44940 per year so the median yearly property tax. Document date 02-08-2021 2017 TENTATIVE Assessment Roll. The general tax levy is determined in accordance with State Law and is limited to 1 assessed value of your property.

West Virginia has one of the lowest median property tax rates in the United States with only two states collecting a lower median property tax than West Virginia.

The Property Tax Inheritance Exclusion

Taxation In California Wikipedia

Santa Clara County Death Statement Fill Online Printable Fillable Blank Pdffiller

Shasta County Ca Property Tax Search And Records Propertyshark

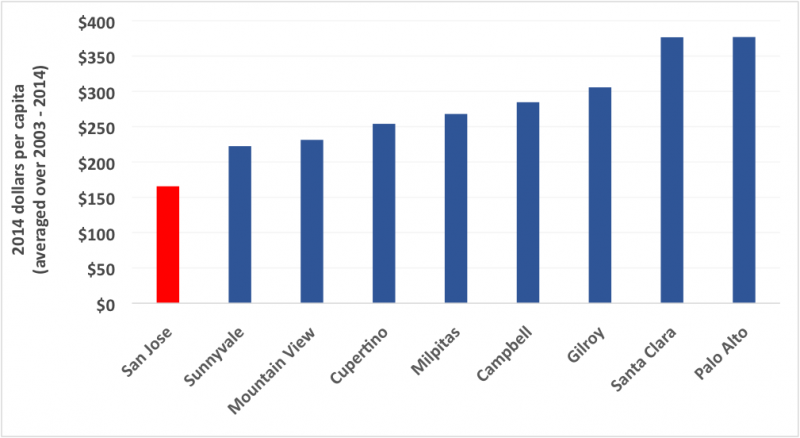

Strengthening The Budget Of The Bay Area S Largest City Spur

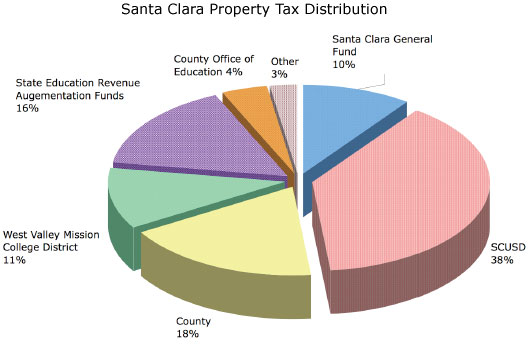

City S General Fund Gets Small Share Of Santa Clara Property Tax Dollars The Silicon Valley Voice

Understanding California S Property Taxes

Property Tax California H R Block

Santa Clara County Grant Deed Form Fill Online Printable Fillable Blank Pdffiller

Property Taxes Department Of Tax And Collections County Of Santa Clara

California 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Santa Clara County Ca Property Tax Calculator Smartasset

By Santa Clara County Controller Treasurer S Office Ppt Download

Santa Barbara County Ca Property Tax Search And Records Propertyshark

Special Fund On Santa Clara County Property Tax Bill Pays For Employee Pensions The Mercury News

Good News For Homeowners Property Taxes Will Barely Go Up In 2014 The Mercury News

Property Taxes Department Of Tax And Collections County Of Santa Clara

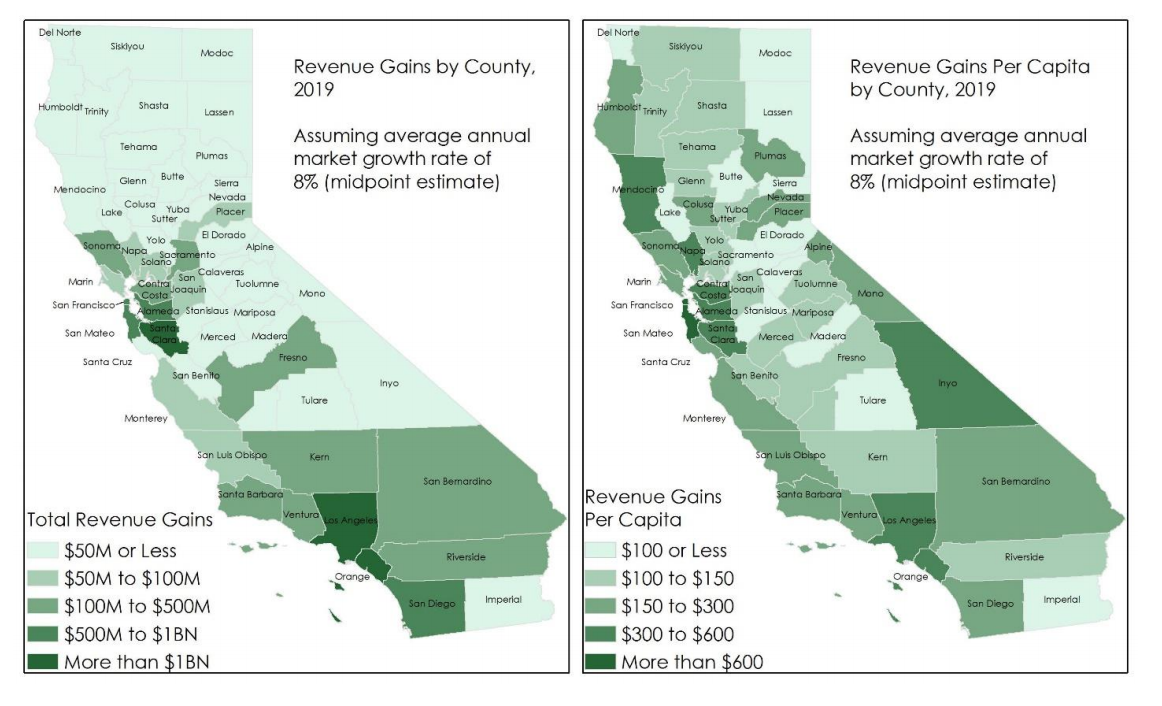

The Split Roll Initiative California S New Hope For Its Property Tax Loophole Berkeley Political Review